Proxy sthealth capital investment corporation Annual meeting of a liquidity event (as such termstockholders July 24, 2019, 8:00 a.m. (eastern Daylight Time) This Proxy is defined in the Prospectus) as the Adviser shall determine. The Base Management Fee for any partial quarter shall be appropriately prorated.

(b)Incentive Fee. The Incentive Fee shall consistsolicited on Behalf of two parts, as follows:

| (i) | The first part, referred to as the “Subordinated Incentive Fee on Interest or Dividend Income,” shall be calculated and payable quarterly in arrears based on the Corporation’s “Pre-Incentive Fee Net Investment Income” for the immediately preceding quarter. The payment of the Subordinated Incentive Fee on Interest or Dividend Income shall be subject to payment of a preferred return to investors each quarter, expressed as a quarterly rate of return on the average Adjusted Capital (as defined below) for the most recently completed calendar quarter, of 0.496% (2.0% annualized), subject to a “catch up” feature (as described below). |

For this purpose, “Pre-Incentive Fee Net Investment Income” means interest income, dividend income and any other income (including any other fees, other than fees for providing managerial assistance, such as commitment, origination, structuring, diligence and consulting fees or other fees that the Corporation receives from portfolio companies) accrued during the calendar quarter, minus the Corporation’s operating expenses for the quarter (including the Base Management Fee, expenses reimbursed to the Adviser under this Agreement and any interest expense and dividends paid on any issued and outstanding preferred stock, but excluding the Incentive Fee). Pre-Incentive Fee Net Investment Income includes, in the case of investments with a deferred interest feature (such as original issue discount debt instruments with payment-in-kind interest and zero coupon securities), accrued income that the Corporation has not yet received in cash. Pre-Incentive Fee Net Investment Income does not include any realized capital gains, realized capital losses or unrealized capital appreciation or depreciation.

For purposes of this fee, “Adjusted Capital” shall mean cumulative gross proceeds generated by the Corporation from sales of shares of Common Stock (including proceeds from the Corporation’s distribution reinvestment plan) reduced for amounts paid for share repurchases pursuant to the Corporation’s share repurchase program.

The calculation of the Subordinated Incentive Fee on Interest or Dividend Income for each quarter is as follows:

| (A) | No Subordinated Incentive Fee on Interest or Dividend Income shall be payable to the Adviser in any calendar quarter in which the Corporation’s Pre-Incentive Fee Net Investment Income does not exceed the preferred return rate of 0.496% (2.0% annualized) (the “Preferred Return”) on Adjusted Capital; |

| (B) | 100% of the Corporation’s Pre-Incentive Fee Net Investment Income, if any, that exceeds the Preferred Return but is less than or equal to 0.619% in any calendar quarter (2.5% annualized) shall be payable to the Adviser. This portion of the Corporation’s Subordinated Incentive Fee on Interest or Dividend Income that exceeds the Preferred Return but is less than or equal to 0.619% is referred to as the “catch up” and is intended to provide the Adviser with an incentive fee of 20.0% on all of the Corporation’s Pre-Incentive Fee Net Investment Income when the Corporation’s Pre-Incentive Fee Net Investment Income reaches 0.619% in any calendar quarter (2.5% annualized); and |

| (C) | 20.0% of the amount of the Corporation’s Pre-Incentive Fee Net Investment Income, if any, that exceeds 0.619% in any calendar quarter (2.5% annualized) shall be payable to the Adviser once the Preferred Return and catch-up have been achieved (20.0% of the Corporation’s Pre-Incentive Fee Net Investment Income thereafter shall be allocated to the Adviser). |

| (ii) | The second part of the incentive fee, referred to as the “Incentive Fee on Capital Gains,” shall be an incentive fee on capital gains and shall be determined and payable in arrears as of the end of each quarter (or upon termination of this Agreement). This fee shall equal 20.0% of the Corporation’s incentive fee capital gains, which shall equal the Corporation’s realized capital gains on a cumulative basis from inception, calculated as of the end of the applicable period, computed net of all realized capital losses and unrealized capital depreciation on a cumulative basis, less the aggregate amount of any previously paid capital gain incentive fees. Incentive fees not paid at the end of the calendar year in which they were earned will accrue until such time when the management chooses to pay them. |

4.Covenants of the Adviser.

(a)Adviser Status. The Adviser covenants that it will be registered as an investment adviser under the Advisers Act when it is required to so register and will maintain such registration until such time as its registration is no longer within the SEC’s jurisdiction under Sections 203 and 203A of the Advisers Act. The Adviser agrees to perform its duties and obligations to the Corporation and otherwise conduct its business and operations as if it were registered as an investment adviser with the SEC under the Advisers Act. The Adviser agrees that it owes the Corporation the same fiduciary duties as if it were registered as an investment adviser with the SEC under the Advisers Act. The Adviser agrees that its activities will at all times be in compliance in all material respects with all applicable federal and state laws governing its operations and investments.

The following provisions in this Section 4 shall apply for only so long as shares of Common Stock are not listed on a national securities exchange.

(b)Reports to Stockholders. The Adviser shall prepare or shall cause to be prepared and distributed to stockholders during each year the following reports of the Corporation (either included in a periodic report filed with the SEC or distributed in a separate report):

| (i) | Quarterly Reports. Within 60 days of the end of each quarter, a report containing the same financial information contained in the Corporation’s Quarterly Report on Form 10-Q filed by the Corporation under the Securities Exchange Act of 1934, as amended. |

| (ii) | Annual Report. Within 120 days after the end of the Corporation’s fiscal year, an annual report containing: |

| (A) | A balance sheet as of the end of each fiscal year and statements of income, equity, and cash flow, for the year then ended, all of which shall be prepared in accordance with generally accepted accounting principles and accompanied by an auditor’s report containing an opinion of an independent certified public accountant; |

| (B) | A report of the activities of the Corporation during the period covered by the report; |

| (C) | Where forecasts have been provided to the Corporation’s stockholders, a table comparing the forecasts previously provided with the actual results during the period covered by the report; and |

| (D) | A report setting forth distributions by the Corporation for the period covered thereby and separately identifying distributions from (i) cash flow from operations during the period; (ii) cash flow from operations during a prior period which have been held as reserves; and (iii) proceeds from disposition of the Corporation’s assets. |

| (iii) | Previous Reimbursement Reports. The Adviser shall prepare or shall cause to be prepared a report, prepared in accordance with the American Institute of Certified Public Accountants United States Auditing Standards relating to special reports, and distributed to stockholders not less than annually, containing an itemized list of the costs reimbursed to the Adviser pursuant to Section 2(c) for the previous fiscal year. The special report shall at a minimum provide: |

| (A) | A review of the allocations of individual employees, the costs of whose services were reimbursed; and |

| (B) | A review of the specific nature of the work performed by each such employee. |

| (iv) | Proposed Reimbursement Reports. The Adviser shall prepare or shall cause to be prepared a report containing an itemized estimate of all proposed expenses for which it shall receive reimbursements pursuant to Section 2(c) of this Agreement for the next fiscal year, together with a breakdown by year of such expenses reimbursed in each of the last five public programs formed by the Adviser. |

(c)Reports to Administrators. The Adviser shall, upon written request of any Administrator, submit any of the reports and statements to be prepared and distributed by it pursuant to this Section 4 to such Administrator.

(d)Reserves. In performing its duties hereunder, the Adviser shall cause the Corporation to provide for adequate reserves for normal replacements and contingencies (but not for payment of fees payable to the Adviser hereunder) by causing the Corporation to retain a reasonable percentage of proceeds from offerings and revenues.

(e)Recommendations Regarding Reviews. From time to time and not less than quarterly, the Adviser must review the Corporation’s accounts to determine whether cash distributions are appropriate. The Corporation may, subject to authorization by the Board, distribute pro rata to the stockholders funds received by the Corporation which the Adviser deems unnecessary to retain in the Corporation. In no event, however, shall funds be advanced to, or borrowed by, the Corporation for the purpose of distributions, if the amount of such distributions would exceed the Corporation’s accrued and received revenues for the previous four quarters, less paid and accrued operating costs with respect to such revenues, and costs shall be made in accordance with generally accepted accounting principles, consistently applied.

(f)Temporary Investments. The Adviser shall, in its sole discretion, temporarily place proceeds from offerings by the Corporation into short term, highly liquid investments which, in its reasonable judgment, afford appropriate safety of principal during such time as it is determining the composition and allocation of the portfolio of the Corporation and the nature, timing and implementation of any changes thereto pursuant to Section 1(b); provided however, that the Adviser shall be under no fiduciary obligation to select any such short-term, highly liquid investment based solely on any yield or return of such investment. The Adviser shall cause any proceeds of the offering of the Corporation’s securities not committed for investment within the later of two years from the initial date of effectiveness of the Registration Statement or one year from termination of the offering, unless a longer period is permitted by the applicable Administrator, to be paid as a distribution to the stockholders of the Corporation as a return of capital without deduction of Front End Fees (as defined below).

5.Brokerage Commissions, Limitations on Front End Fees; Period of Offering; Assessments.

(a)Brokerage Commissions. The Adviser is hereby authorized, to the fullest extent now or hereafter permitted by law, to cause the Corporation to pay a member of a national securities exchange, broker or dealer an amount of commission for effecting a securities transaction in excess of the amount of commission another member of such exchange, broker or dealer would have charged for effecting that transaction, if the Adviser determines in good faith, taking into account such factors as price (including the applicable brokerage commission or dealer spread), size of order, difficulty of execution, and operational facilities of the firm and the firm’s risk and skill in positioning blocks of securities, that such amount of commission is reasonable in relation to the value of the brokerage and/or research services provided by such member, broker or dealer, viewed in terms of either that particular transaction or its overall responsibilities with respect to the Corporation’s portfolio, and constitutes the best net results for the Corporation.

The following provisions in this Section 5 shall apply for only so long as shares of Common Stock are not listed on a national securities exchange.

(b)Limitations. Notwithstanding anything herein to the contrary:

| (i) | All fees and expenses paid by any party for any services rendered to organize the Corporation and to acquire assets for the Corporation (“Front End Fees”) shall be reasonable and shall not exceed 15% of the gross offering proceeds, regardless of the source of payment. Any reimbursement to the Adviser or any other person for deferred organizational and offering expenses, including any interest thereon, if any, will be included within this 15% limitation. |

| (ii) | The Adviser shall commit at least eighty-two percent (82%) of the gross offering proceeds towards the investment or reinvestment of assets and reserves as set forth in Section 4(d) above on behalf of the Corporation. The remaining proceeds may be used to pay Front End Fees. |

6.Other Activities of the Adviser.

The services of the Adviser to the Corporation are not exclusive, and the Adviser may engage in any other business or render similar or different services to others including, without limitation, the direct or indirect sponsorship or management of other investment based accounts or commingled pools of capital, however structured, having investment objectives similar to those of the Corporation, so long as its services to the Corporation hereunder are not impaired thereby, and nothing in this Agreement shall limit or restrict the right of any manager, partner, member (including its members and the owners of its members), officer or employee of the Adviser to engage in any other business or to devote his or her time and attention in part to any other business, whether of a similar or dissimilar nature, or to receive any fees or compensation in connection therewith (including fees for serving as a director of, or providing consulting services to, one or more of the Corporation’s portfolio companies, subject to applicable law). The Adviser assumes no responsibility under this Agreement other than to render the services called for hereunder. It is understood that directors, officers, employees and stockholders of the Corporation are or may become interested in the Adviser and its affiliates, as directors, officers, employees, partners, stockholders, members, managers or otherwise, and that the Adviser and directors, officers, employees, partners, stockholders, members and managers of the Adviser and its affiliates are or may become similarly interested in the Corporation as stockholders or otherwise.

7.Responsibility of Dual Directors, Officers and/or Employees.

If any person who is a manager, partner, member, officer or employee of the Adviser is or becomes a director, officer and/or employee of the Corporation and acts as such in any business of the Corporation, then such manager, partner, member, officer and/or employee of the Adviser shall be deemed to be acting in such capacity solely for the Corporation, and not as a manager, partner, member, officer or employee of the Adviser or under the control or direction of the Adviser, even if paid by the Adviser.

8.Indemnification; Limitation of Liability.

(a)Indemnification. The Adviser (and its officers, managers, partners, members (and their members, including the owners of their members), agents, employees, controlling persons and any other person or entity affiliated with the Adviser) shall not be liable to the Corporation for any action taken or omitted to be taken by the Adviser or such other person in connection with the performance of any of its duties or obligations under this Agreement or otherwise as an investment adviser of the Corporation (except to the extent specified in Section 36(b) of the Investment Company Act concerning loss resulting from a breach of fiduciary duty (as the same is finally determined by judicial proceedings)) with respect to the receipt of compensation for services, and the Corporation shall indemnify, defend and protect the Adviser (and its officers, managers, partners, members (and their members, including the owners of their members), agents, employees, controlling persons and any other person or entity affiliated with the Adviser, each of whom shall be deemed a third party beneficiary hereof) (collectively, the “Indemnified Parties”) and hold them harmless from and against all damages, liabilities, costs and expenses (including reasonable attorneys’ fees and amounts reasonably paid in settlement) incurred by the Indemnified Parties in or by reason of any pending, threatened or completed action, suit, investigation or other proceeding (including an action or suit by or in the right of the Corporation or its security holders) arising out of or otherwise based upon the performance of any of the Adviser’s duties or obligations under this Agreement or otherwise as an investment adviser of the Corporation, to the extent such damages, liabilities, costs and expenses are not fully reimbursed by insurance, and to the extent that such indemnification would not be inconsistent with the laws of the State of Maryland, the Articles or, for only as long as the shares of Common Stock are not listed on a national securities exchange, the provisions of Section II.G of the Omnibus Guidelines published by the North American Securities Administrators Association on March 29, 1992, as it may be amended from time to time. Notwithstanding the preceding sentence of this Section 8 to the contrary, nothing contained herein shall protect or be deemed to protect the Indemnified Parties against or entitle or be deemed to entitle the Indemnified Parties to indemnification in respect of any liability to the Corporation or its stockholders to which the Indemnified Parties would otherwise be subject by reason of willful misfeasance, bad faith or gross negligence in the performance of the Adviser’s duties or by reason of the reckless disregard of the Adviser’s duties and obligations under this Agreement (to the extent applicable, as the same shall be determined in accordance with the Investment Company Act and any interpretations or guidance by the SEC or its staff thereunder). As long as the shares of Common Stock are not listed on a national securities exchange, nothing in the preceding sentence shall be construed to limit the scope or applicability of Sections 8(b) and 8(c).

The following provisions in this Section 8 shall apply for only so long as shares of Common Stock are not listed on a national securities exchange.

(b)Limitations on Indemnification. Notwithstanding Section 8(a) to the contrary, the Corporation shall not provide for indemnification of the Indemnified Parties for any liability or loss suffered by the Indemnified Parties, nor shall the Corporation provide that any of the Indemnified Parties be held harmless for any loss or liability suffered by the Corporation, unless all of the following conditions are met:

| (i) | the Indemnified Party has determined, in good faith, that the course of conduct which caused the loss or liability was in the best interests of the Corporation; |

| (ii) | the Indemnified Party was acting on behalf of or performing services for the Corporation; |

| (iii) | such liability or loss was not the result of negligence or misconduct by the Indemnified Party; and |

| (iv) | such indemnification or agreement to hold harmless is recoverable only out of the Corporation’s net assets and not from stockholders. |

Furthermore, the Indemnified Party shall not be indemnified for any losses, liabilities or expenses arising from or out of an alleged violation of federal or state securities laws unless one or more of the following conditions are met:

| (i) | there has been a successful adjudication on the merits of each count involving alleged material securities law violations; |

| (ii) | such claims have been dismissed with prejudice on the merits by a court of competent jurisdiction; or |

| (iii) | a court of competent jurisdiction approves a settlement of the claims against a particular indemnitee and finds that indemnification of the settlement and related costs should be made, and the court of law considering the request for indemnification has been advised of the position of the SEC and the published position of any state securities regulatory authority in which securities of the Corporation were offered or sold as to indemnification for violations of securities laws. |

(c)Advancement of Funds. The Corporation shall be permitted to advance funds to the Indemnified Party for legal expenses and other costs incurred as a result of any legal action for which indemnification is being sought and will do so if:

| (i) | the proceeding relates to acts or omissions with respect to the performance of duties or services on behalf of the Corporation; |

| (ii) | the Indemnified Party provides the Corporation with written affirmation of his or her good faith belief that the standard of conduct necessary for indemnification by the Corporation has been met; |

| (iii) | the legal proceeding was initiated by a third party who is not a stockholder or, if by a stockholder of the Corporation acting in his or her capacity as such, a court of competent jurisdiction approves such advancement; and |

| (iv) | the Indemnified Party provides the Corporation with a written agreement to repay the amount paid or reimbursed by the Corporation, together with the applicable legal rate of interest thereon, in cases in which such Indemnified Party is found not to be entitled to indemnification. |

9.Effectiveness, Duration and Termination of Agreement.

(a)Term and Effectiveness. This Agreement shall become effective on the date first set forth above, such being the date on which this Agreement has been executed following: (1) approval of the Corporation’s Board of Directors, including approval by a vote of a majority of the Directors who are not “interested persons” (as defined in the 1940 Act) of the Adviser or the Corporation, cast in person at a meeting called for the purpose of voting on such approval; (2) the approval by a “vote of a majority of the outstanding voting securities” (as defined in the 1940 Act) of the Corporation. Unless terminated as herein provided, this Agreement shall remain in full force and effect until the date that is two years after the effective date of this Agreement. Subsequent to such initial period of effectiveness, this Agreement shall continue in full force and effect, subject to paragraph 9(b), so long as such continuance is approved at least annually (a) by either the Corporation’s Board of Directors or by a “vote of a majority of the outstanding voting securities” (as defined in the 1940 Act) of the Corporation and (b) in either event, by the vote of a majority of the Directors of the Corporation who are not parties to this Agreement or “interested persons” (as defined in the 1940 Act) of any such party, cast in person at a meeting called for the purpose of voting on such approval.

(b)Termination. This Agreement may be terminated at any time, without the payment of any penalty, by the vote of the Corporation’s Board of Directors or by the “vote of a majority of the outstanding voting securities” or by the Adviser in each case on not more than 60 days’ prior written notice to the other party. This Agreement shall automatically terminate in the event of its “assignment” (as such term is defined for purposes of Section 15(a)(4) of the Investment Company Act). Further, notwithstanding the termination or expiration of this Agreement as aforesaid, the Adviser shall be entitled to any amounts owed to it under Section 3 through the date of termination or expiration, the provisions of Section 8 of this Agreement shall remain in full force and effect, and the Adviser shall remain entitled to the benefits thereof.

(c)Payments to and Duties of Adviser Upon Termination.

| (i) | After the termination of this Agreement, the Adviser shall not be entitled to compensation for further services provided hereunder, except that it shall be entitled to receive from the Corporation within 30 days after the effective date of such termination all unpaid reimbursements and all earned but unpaid fees payable to the Adviser prior to termination of this Agreement. |

| (ii) | The Adviser shall promptly upon termination: |

| (A) | Deliver to the Board a full accounting, including a statement showing all payments collected by it and a statement of all money held by it, covering the period following the date of the last accounting furnished to the Board; |

| (B) | Deliver to the Board all assets and documents of the Corporation then in custody of the Adviser; and |

| (C) | Cooperate with the Corporation to provide an orderly management transition. |

The following provisions in this Section 9 shall apply for only so long as shares of Common Stock are not listed on a national securities exchange.

(d)Other Matters. Without the approval of holders of a majority of the shares of Common Stock entitled to vote on the matter, the Adviser shall not: (i) amend this Agreement except for amendments that do not adversely affect the interests of the stockholders; (ii) voluntarily withdraw as the Adviser unless such withdrawal would not affect the tax status of the Corporation and would not materially adversely affect the stockholders; (iii) appoint a new Adviser; (iv) sell all or substantially all of the Corporation’s assets other than in the ordinary course of the Corporation’s business; or (v) cause the merger or other reorganization of the Corporation. In the event that the Adviser should withdraw pursuant to (ii) above, the withdrawing Adviser shall pay all expenses incurred as a result of its withdrawal. The Corporation may terminate the Adviser’s interest in the Corporation’s revenues, expenses, income, losses, distributions and capital by payment of an amount equal to the then present fair market value of the terminated Adviser’s interest, determined by agreement of the terminated Adviser and the Corporation. If the Corporation and the Adviser cannot agree upon such amount, then such amount will be determined in accordance with the then-current rules of the American Arbitration Association. The expenses of such arbitration shall be borne equally by the terminated Adviser and the Corporation. The method of payment to the terminated Adviser must be fair and must protect the solvency and liquidity of the Corporation.

10.Conflicts of Interests and Prohibited Activities.

The following provisions in this Section 10 shall apply for only so long as shares of Common Stock are not listed on a national securities exchange.

(a)No Exclusive Agreement. The Adviser is not hereby granted or entitled to an exclusive right to sell or exclusive employment to sell assets for the Corporation.

(b)Rebates, Kickbacks and Reciprocal Arrangements.

| (i) | The Adviser agrees that it shall not (A) receive or accept any rebate, give-up or similar arrangement that is prohibited under applicable federal or state securities laws, (B) participate in any reciprocal business arrangement that would circumvent provisions of applicable federal or state securities laws governing conflicts of interest or investment restrictions, or (C) enter into any agreement, arrangement or understanding that would circumvent the restrictions against dealing with affiliates or promoters under applicable federal or state securities laws. |

| (ii) | The Adviser agrees that it shall not directly or indirectly pay or award any fees or commissions or other compensation to any person or entity engaged to sell shares of Common Stock or give investment advice to a potential stockholder; provided, however, that this subsection shall not prohibit the payment to a registered broker-dealer or other properly licensed agent of sales commissions for selling or distributing shares of Common Stock. |

(c)Commingling. The Adviser covenants that it shall not permit or cause to be permitted the Corporation’s funds to be commingled with the funds of any other entity. Nothing in this Subsection 10(c) shall prohibit the Adviser from establishing a master fiduciary account pursuant to which separate sub-trust accounts are established for the benefit of affiliated programs, provided that the Corporation’s funds are protected from the claims of other programs and creditors of such programs.

11.Notices.

Any notice under this Agreement shall be given in writing, addressed and delivered or mailed, postage prepaid, to the other party at its principal office.

12.Amendments.

This Agreement may be amended in writing by mutual consent of the parties hereto, subject to the provisions of the Investment Company Act and the Articles.

13.Entire Agreement; Governing Law.

This Agreement contains the entire agreement of the parties and supersedes all prior agreements, understandings and arrangements with respect to the subject matter hereof. Notwithstanding the place where this Agreement may be executed by any of the parties hereto, this Agreement shall be construed in accordance with the laws of the State of New York. For so long as the Corporation is regulated as a BDC under the Investment Company Act and the Adviser is regulated as an investment adviser under the Advisers Act, this Agreement shall also be construed in accordance with the applicable provisions of the Investment Company Act and the Advisers Act, respectively, and any other then-current regulatory interpretations thereunder. To the extent the applicable laws of the State of New York, or any of the provisions herein, conflict with the provisions of the Investment Company Act, the latter shall control.

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be duly executed on the date above written.

FIRST CAPITAL INVESTMENT CORPORATION | |

| |

By:

| | |

Name: | Reid Maclellan | |

Title: | Chief Operating Officer | |

| |

FCIC ADVISORS LLC | |

| |

By:

| | |

Name: | Derek Taller | |

Title: | Chief Executive Officer | |

[Signature Page to Investment Advisory Agreement]

Appendix A

NOTE: All percentages herein refer to Adjusted Capital.

Example 1: Subordinated Incentive Fee on Interest or Dividend Income for Each Calendar Quarter

Scenario 1

Assumptions

Investment income (including interest, dividends, fees, etc.) = 1.00%

Preferred return(1) = 0.496%

Base Management Fee(2) = 0.5%

Other expenses (legal, accounting, custodian, transfer agent, etc.)(3) = 0.2%

Pre-Incentive Fee Net Investment Income

(investment income – (Base Management Fee + other expenses)) = 0.30%

Pre-Incentive Fee Net Investment Income does not exceed the preferred return rate, therefore there is no Subordinated Incentive Fee on Interest or Dividend Income payable.

Scenario 2

Assumptions

Investment income (including interest, dividends, fees, etc.) = 1.25%

Preferred return(1) = 0.496%

Base Management Fee(2) = 0.5%

Other expenses (legal, accounting, custodian, transfer agent, etc.)(3) = 0.2%

Pre-Incentive Fee Net Investment Income

(investment income – (Base Management Fee + other expenses)) = 0.55%

Subordinated Incentive Fee on Interest or Dividend Income = 100% × Pre-Incentive Fee Net Investment Income (subject to “catch-up”)(4)

= 100% x (0.550% – 0.496%)

= 0.054%

Pre-Incentive Fee Net Investment Income exceeds the preferred return rate, but does not fully satisfy the “catch-up” provision, therefore the Subordinated Incentive Fee on Interest or Dividend Income is 0.054%.

Scenario 3

Assumptions

Investment income (including interest, dividends, fees, etc.) = 3.5%

Preferred return(1) = 0.496%

Base Management Fee(2) = 0.5%

Other expenses (legal, accounting, custodian, transfer agent, etc.)(3) = 0.2%

Pre-Incentive Fee Net Investment Income

(investment income – (Base Management Fee + other expenses)) = 2.8%

Catch up = 100% × Pre-Incentive Fee Net Investment Income (subject to “catch-up”)(4)

Subordinated Incentive Fee on Interest or Dividend Income = 100% × “catch-up” + (20.0% × (Pre-Incentive Fee Net Investment Income – 0.619%))

Catch up = 0.619% – 0.496%

= 0.00123%

Subordinated Incentive Fee on Interest or Dividend Income = (100% × 0.00123%) + (20.0% × (2.8%-0.619%))

= 0.123% + (20.0% × 2.181%)

= 0.123% + 0.4362%

= 0.56%

Pre-Incentive Fee Net Investment Income exceeds the preferred return and fully satisfies the “catch-up” provision, therefore the Subordinated Incentive Fee on Interest or Dividend Income is 0.56%.

| (5) | Represents 2.0% annualized preferred return. |

| (6) | Represents 2.0% annualized Base Management Fee on average monthly gross assets. Examples assume assets are equal to Adjusted Capital. |

| (7) | Excludes organizational and offering expenses. |

| (8) | The “catch-up” provision is intended to provide the Adviser with an incentive fee of 20.0% on all Pre-Incentive Fee Net Investment Income when the Corporation’s net investment income exceeds 0.619% in any calendar quarter. |

Example 2: Incentive Fee on Capital Gains

Scenario 1:

Assumptions

Year 1: $20 million investment made in Company A (“Investment A”), and $30 million investment made in Company B (“Investment B”)

Year 2: Investment A sold for $50 million and fair market value (“FMV”) of Investment B determined to be $32 million

Year 3: FMV of Investment B determined to be $25 million

Year 4: Investment B sold for $31 million

The Incentive Fee on Capital Gains would be:

Year 1: None

Year 2: Incentive Fee on Capital Gains of $6 million ($30 million realized capital gains on sale of Investment A multiplied by 20.0%)

Year 3: None → $5 million (20.0% multiplied by ($30 million cumulative capital gains less $5 million cumulative capital depreciation)) less $6 million (previous capital gains fee paid in Year 2)

Year 4: Incentive Fee on Capital Gains of $200,000 → $6.2 million ($31 million cumulative realized capital gains multiplied by 20.0%) less $6 million (Incentive Fee on Capital Gains taken in Year 2)

Scenario 2

Assumptions

Year 1: $20 million investment made in Company A (“Investment A”), $30 million investment made in Company B (“Investment B”) and $25 million investment made in Company C (“Investment C”)

Year 2: Investment A sold for $50 million, FMV of Investment B determined to be $25 million and FMV of Investment C determined to be $25 million

Year 3: FMV of Investment B determined to be $27 million and Investment C sold for $30 million

Year 4: FMV of Investment B determined to be $35 million

Year 5: Investment B sold for $20 million

The capital gains incentive fee, if any, would be:

Year 1: None

Year 2: $5 million Incentive Fee on Capital Gains → 20.0% multiplied by $25 million ($30 million realized capital gains on Investment A less unrealized capital depreciation on Investment B)

Year 3: $1.4 million Incentive Fee on Capital Gains → $6.4 million (20.0% multiplied by $32 million ($35 million cumulative realized capital gains less $3 million unrealized capital depreciation)) less $5 million Incentive Fee on Capital Gains received in Year 2

Year 4: None

Year 5: None → $5 million (20.0% multiplied by $25 million (cumulative realized capital gains of $35 million less realized capital losses of $10 million)) less $6.4 million cumulative Incentive Fee on Capital Gains paid in Year 2 and Year 3

* The returns shown are for illustrative purposes only. No Subordinated Incentive Fee on Interest or Dividend Income is payable to the Adviser in any calendar quarter in which the Company’s pre-incentive fee net investment income does not exceed the hurdle rate. Positive returns are shown to demonstrate the fee structure and there is no guarantee that positive returns will be realized. Actual returns may vary from those shown in the examples above.

EXHIBIT C

Nominating and Corporate Governance Committee Charter

FIRST CAPITAL INVESTMENT CORPORATION

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE CHARTER

I.Statement of Purpose

The Nominating and Corporate Governance Committee (the “Committee”) is a standing committee established by the Board of Directors (the “Board”) of First Capital Investment Corporation (the “Company”). The purpose of the Committee is to assist the Board in fulfilling its oversight responsibilities related to:

| A. | Identifying individuals qualified to become members of the Board; |

| B. | Selecting or recommending to the Board the director nominees for each annual meeting of shareholders; |

| C. | Developing and recommending to the Board a set of corporate governance principles applicable to the Company; |

| D. | Planning for the succession of the Company’s executive officers, if any; |

| E. | Overseeing the evaluation of the Board, its committees and management; and |

| F. | Recommending to the Board the compensation to be paid to the independent directors of the Board. |

II.Membership and Qualifications

Membership: The Committee shall consist of at least two (2) independent members of the Board. Members of the Committee shall be nominated by the Committee annually and as vacancies or newly created positions occur. Members of the Committee shall be appointed by the Board of Directors.

Qualifications: Each member of the Committee may not be an “interested person” of the Company, as that term is defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended, and must meet the requirements of a “non-employee director” for purposes of Section 16 of the Securities Exchange Act of 1934, as amended. If and when the Company lists its shares on a national securities exchange, the members of the Committee shall meet the requirements of such exchange. The Board shall annually review the Committee’s compliance with such requirements.

Chairman: Unless a Chairman is elected by the full Board, the members of the Committee may designate a Chairman by majority vote of the full Committee membership.

Resignation, Removal and Replacement: Any member of the Committee may resign from the Committee at any time upon notice of such resignation to the Company. The Board shall have the power at any time to remove a member of the Committee with or without cause, to fill all vacancies, and to designate alternate members, upon the recommendation of the Committee, to replace any absent or disqualified members.

III.Procedures

The Committee will meet at least once per year and at such additional times as may be necessary to carry out its responsibilities. The Chairman of the Committee, in consultation with the other committee members, shall determine the frequency and length of the Committee meetings and shall set meeting agendas consistent with this charter. Any two members, the Chairman of the Committee, or the Chairman of the Board and/or the Chief Executive Officer of the Company may call a meeting of the Committee whenever deemed necessary.

Action may be taken by the Committee upon the affirmative vote of a majority of the members present at the meeting if a quorum of committee members, as defined in the Company’s bylaws, is present (or where only two members are present, by unanimous vote).

The Committee may invite any member of the Board who is not a member of the Committee, officer, employee, counsel, representative of service provider or other person to attend meetings and provide information to the Committee as appropriate.

An agenda, together with materials relating to the subject matter of each meeting, shall be sent to members of the Committee prior to each meeting. Minutes for all meetings of the Committee shall be prepared to document the Committee’s discharge of its responsibilities. The minutes shall be circulated in draft form to all Committee members to ensure an accurate final record, shall be approved at a subsequent meeting of the Committee and shall be distributed periodically to the full Board.

IV.Goals, Responsibilities and Authority

In carrying out its mission, the Committee shall have direct responsibility and authority to perform the following duties:

Nominating Directors

| G. | Identify individuals qualified to become Board members, consistent with criteria approved by the Board, receive nominations for such qualified individuals, select, or recommend that the Board select, the director nominees for the next annual meeting of shareholders, taking into account each candidate’s ability, judgment and experience and the overall diversity and composition of the Board; |

| H. | Recommend to the Board candidates for election to the Board and evaluate the Board in accordance with criteria set forth below or determined as provided below. |

As part of this responsibility, the Committee shall be responsible for conducting, subject to applicable law, any and all inquiries into the background and qualifications of any candidate for the Board and such candidate’s compliance with the independence and other qualification requirements established by the Committee.

| a. | General Considerations. Each director should: |

| i. | Be an individual possessing high standards of character and integrity, relevant experience, a willingness to ask hard questions and the ability to work well with others; |

| ii. | Be free of conflicts of interest that would violate applicable law or regulation or interfere with the proper performance of the responsibilities of a director; |

| iii. | Be willing and able to devote sufficient time to the affairs of the Company and be diligent in fulfilling the responsibilities of a director and Board Committee member; and |

| iv. | Have the capacity and desire to represent the balanced, best interests of the shareholder as a whole and not a special interest group or constituency. |

| b. | Specific Considerations. The Committee shall review annually the skills, experiences (such as current business experience or other such current involvement in public service, academia or scientific communities), particular areas of expertise, particularbackgrounds, and other characteristics that help ensure the effectiveness of the Board and Board committees. These considerations should: |

| i. | Take into account any particular needs of the Company and may be adjusted as these Company characteristics evolve; |

| ii. | Consider periodically complimentary skills or other attributes, which may not be represented on the Board that would be useful to the Board as it fulfills its duties; and |

| iii. | Be based on a consideration of each individual’s contributions, the availability of director candidates, and the Company’s needs. |

| I. | Monitor Board composition and recommend candidates as necessary to ensure that the number of independent directors serving on the Board satisfies SEC requirements; |

| J. | Review any candidate recommended or nominated by shareholders in light of the Committee’s criteria for selection of new directors, as well as requirements under the Company’s organizational documents and applicable law; |

| K. | Recommend to the Board qualified individuals to serve as committee members on the various Board committees. The Committee shall review and recommend committee slates annually and shall recommend additional committee members to fill vacancies as needed; and |

| L. | Recommend to the Board or to the appropriate committee thereto processes for annual evaluations of the performance of the Board and any executive officers of the Company. In discharging this responsibility, the Committee shall solicit comments from all Directors and report annually to the Board on the results of the evaluation. |

Board of Directors

| A. | Clearly articulate to each director what is expected of their tenure on the Board, including directors’ basic duties and responsibilities with respect to attendance at Board meetings and advance review of meeting materials; |

| B. | Develop and at least annually evaluate orientation guidelines and continuing education guidelines for each member of the Board and each member of each committee thereof regarding his or her responsibilities as a director generally and as a member of any applicable committee of the Board; and |

| C. | Review the Company’s practices and policies with respect to directors, including the size of the Board, the ratio of employee directors to non-employee directors, the meeting frequency of the Board, the structure of Board meetings and the responsibilities of the Board and its Committees and make recommendations to the Board with respect thereto. |

Succession Planning for Chief Executive Officer and Other Executive Officers

| A. | Overseethe maintenance and presentation to the Board of management’s plans for succession to senior management positions in the Company. |

Corporate Governance

| A. | Oversee an annual review of the performance of the full Board and report the results thereof to the full Board; |

| B. | Monitor and make recommendations to the Board on matters of Company policies and practices relating to corporate governance, including development and annual review of the Company’s corporate governance guidelines; |

| C. | Annually evaluate the Company’s code of business conduct and, if appropriate, recommend changes to that code; |

| D. | In concert with the Board, review the Company policies with respect to significant issues of corporate public responsibility, including contributions; |

| E. | Consider and report to the Board any questions of possible conflicts of interest of Board members; and |

| F. | Review shareholder proposals regarding corporate governance and make recommendations to the Board. |

Compensation to be Paid to Independent Directors of the Board

| A. | Atleast annually, review and assess the compensation paid to the independent directors of the Board and make recommendations to the Board with respect to any recommended changes. |

Other

| A. | At least annually, review and assess the adequacy of the charters, structures and operations of this Nominating and Governance Committee and the other existing Board committees, including policies for removal of members and rotation of members among other Committees of the Board, and submit any changes to the Board for approval; |

| B. | Have the sole authority to retain and terminate a search firm to assist in the identification of director candidates and have the authority to approve the search firm’s fees and other retention terms; |

| C. | Have the authority to retain legal, accounting or other experts that it determines to be necessary to carry out its duties and to determine compensation for such advisors; and |

| D. | Carry out such other duties that may be delegated to the Committee by the Board from time to time. |

In discharging its duties hereunder, the Committee shall have full access to any relevant records of the Company and shall have the authority, to the extent it deems necessary or appropriate, to retain independent legal, accounting or other advisors. The Company shall provide for appropriate funding, as determined by the Committee, for payment of compensation to any advisors employed by the Committee, and for ordinary administrative expenses of the Committee that are necessary or appropriate in carrying out its duties.

The Committee may delegate any of its responsibilities to a subcommittee comprised of one or more members of the Committee.

V.Evaluation

The Committee shall evaluate its performance on an annual basis and recommend changes to the Board as needed.

VI.Disclosure of Charter

This charter will be made available as an exhibit to the Proxy Statement filed by the Company with the Securities and Exchange Commission on July 18, 2018.

EVERY STOCKHOLDER’S VOTE IS IMPORTANT

| | |

| | VOTING OPTIONS: |

| | |

|  | VOTE ON THE INTERNET

Log on to:

www.proxyvote.com

or scan the QR code

Follow the on-screen instructions

available 24 hours |

| | |

|  | VOTE BY PHONE

Call 800-690-6903

Follow the recorded instructions

available 24 hours |

| | |

|  | VOTE BY MAIL

Mark, sign and date your proxy card

and return it in the postage-paid

envelope we have provided or return it

to Vote Processing, c/o Broadridge, 51

Mercedes Way, Edgewood, NY 11717. |

| | |

|  | VOTE IN PERSON

Attend Stockholder Meeting

First Capital Investment Corporation

410 Park Avenue, 14th Floor

New York, NY 10022

on August 7, 2018 |

Please detach at perforation before mailing.

PROXY | FIRST CAPITAL INVESTMENT CORPORATION

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON AUGUST 7, 2018 | |

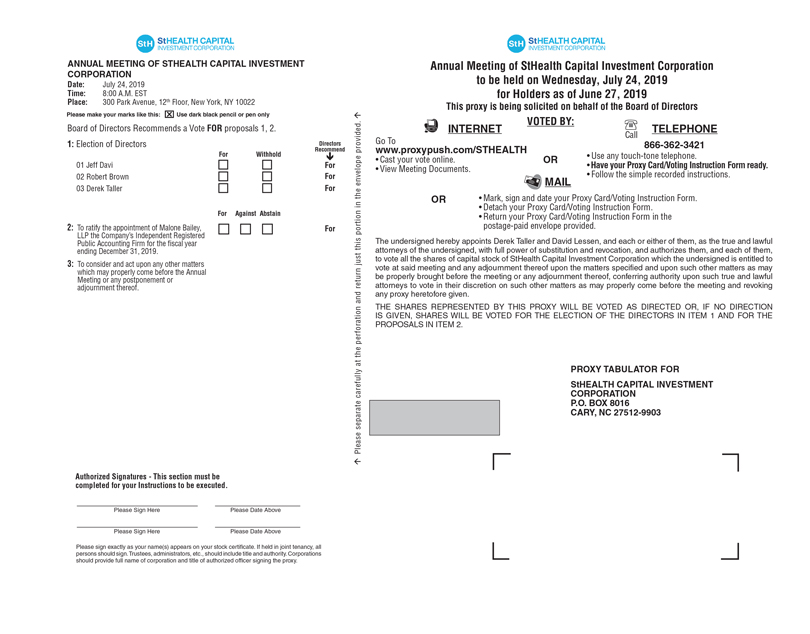

COMMON STOCK

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS.The undersigned holder of shares of First Capital Investment Corporation, a Maryland corporation (the “Company”), hereby appoints Reid MaclellanDerek Taller and David Lessen or any(the Named Proxies) and each of them as proxies for the undersigned, with full power of substitution, in eachto vote the shares of them,common stock of StHealth Capital Investment Corporation, a Maryland corporation (the Company), the undersigned is entitled to attendvote at the Annual Meeting of Stockholders (the “Meeting”)of the Company to be held at the offices of First Capital Investment Corporation, 410300 Park Avenue, 14th12th Floor, New York, NY 10022, on Wednesday, July 24, 2019 at 10:8:00 A.M., Eastern Standard Time, on August 7, 2018,a.m. (EDT) and anyall adjournments or postponements thereof, to cast on behalfthereof. The Notice of the undersigned all votes that the undersigned is entitled to cast at the Meeting and to otherwise represent the undersigned at the Meeting with all the powers possessed by the undersigned if personally present at the Meeting. The undersigned hereby acknowledges receipt of the Notice of Annual Meeting and Proxy Statement (the termsproxy statement accompanying this letter provide an outline of each of which are incorporated by reference herein). The undersigned hereby revokes any proxy previously given with respect to the Meeting.

The votes entitledbusiness to be castconducted at the meeting. The Annual Meeting is being held for the following purposes: (i) to elect three members of the board of directors of the Company to serve until the 2020 annual meeting of stockholders and until their successors are duly elected and qualied (ii) to ratify the appointment of Malone Bailey, LLP the Companys Independent Registered Public Accounting Firm for the scal year ending December 31, 2019; and (iii) to transact such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof. The 3 directors up for re-election are: Jeff Davi, Robert Brown, and Derek Taller. The Board of Directors of the Company recommends a vote FOR all nominees for director and FOR each proposal. This proxy, when properly executed, will be cast as instructed onvoted in the reverse side. Ifmanner directed herein. if no direction is made, this Proxy is executed but no instruction is given, the votes entitled to be cast by the undersignedproxy will be cast “FOR” Proposals 1voted FOR all nominees for director and 3, andFOR each proposal. in their discretion, the lack of instruction will have the same effect as anamed Proxies are authorized to vote “AGAINST” Proposal 2. The votes entitled to be cast by the undersigned will be cast in the discretion of the proxy holder on anyupon such other mattermatters that may properly come before the MeetingAnnual meeting or any adjournment or postponement thereof. You are encouraged to specify your choice by marking the appropriate box (see ReveRse siDe) but you need not mark any box if you wish to vote in accordance with the Board of Directors recommendation. The named Proxies cannot vote your shares unless you sign and return this card. To attend the meeting and vote your shares in person, please mark this box. Please separate carefully at any adjournments or postponements thereof.

| | | | |

| VOTE VIA THE INTERNET: www.proxyvote.com |

| VOTE VIA THE TELEPHONE: 800-690-6903 |

| | | | |

PLEASE MARK, SIGN, DATE AND RETURN THE PROXY CARD USING THE ENCLOSED ENVELOPE.

EVERY STOCKHOLDER’S VOTE IS IMPORTANT

Important Notice Regarding the Availability of Proxy Materials for the

Annual Stockholder Meeting to Be Held on August 7, 2018.

The Notice of Annual Meeting, Proxy Statementperforation and Proxy Card forreturn just this meeting are

available at:

www.proxyvote.com

IF YOU VOTE BY TELEPHONE OR INTERNET,

PLEASE DO NOT MAIL YOUR CARD

Please detach at perforation before mailing.

If this proxy is properly executed, the votes entitled to be cast by the undersigned will be castportion in the manner directed by the undersigned stockholder. IF NO DIRECTION IS MADE, THE VOTES ENTITLED TO BE CAST BY THE UNDERSIGNED WILL BE CAST “FOR” PROPOSALS 1 AND 3 AND WILL HAVE THE SAME EFFECT AS VOTES “AGAINST” PROPOSAL 2. ADDITIONALLY, the VOTES ENTITLED TO BE CAST BY THE UNDERSIGNED WILL BE CAST IN THE DISCRETION OF THE PROXY HOLDER ON ANY OTHER MATTER THAT MAY PROPERLY COME BEFORE THE MEETING AND ANY ADJOURNMENTS OR POSTPONEMENTS THEREOF.envelope provided.